There was only one big story that popped up on my screen today* and that was the regulators announcing that they were handing out fines of £2.6 billion to six banks for attempted manipulation of foreign exchange rates (FOREX).

The fines provide proof that the regulators found evidence to show that dealers from competing banks were sharing confidential information in order to coordinate their trades simply to boost their own profits.

As the prices of currencies change rapidly and continuously to reflect the rise and fall of demand, a system has been developed whereby the price of each currency is fixed according to the trades immediately before and after a set time every day.

That figure is critical as it’s then used to influence a whole range of other financial benchmarks. So what you actually have (or had – if you’re of the view that financial penalties actually prevent individuals simply seeking similar profitable opportunities in the future when they have power over huge sums of money within large opaque organisations) is an opportunity for unscrupulous traders to co-ordinate their activities via chat rooms in order to attempt to influence the price and to make money.

If you want more details, I suggest you check out Zero Hedge for some examples of how some serious money was made.

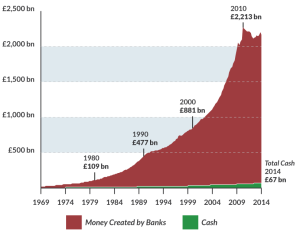

To put the fines into perspective, the FOREX market is one in which £3.3 trillion was traded every day in 2013 on average. Compare that to the size of the UK economic output in the same year (£1.6 trillion). London accounts for 41% of the global FOREX market according to statistics from the same year.

But is it now back to business as usual for the banks? What do you think – a few bad apples or wholescale cultural change? Interesting to note that the Bank of England was warned that there was currency market rigging in May 2008 and again in 2011 yet didn’t actually act until 2013.

Channel 4 Economics Editor Paul Mason has his own view on the matter:-

Surely the question here, however, is not whether more regulation will be successful in the future – but whether a model of centralised regulation which risks the capture of regulators is in fact more dangerous as it lulls us all into a false sense of security.

Nice work gents, indeed.

*That’s a lie of course. A far more uplifting, and positive story, is the fact that the European Space Agency successfully landed the Philae spacecraft on a comet. But, you know.**

**And, um, that’s not even mentioning the fact that Counterparty just managed to recreate Ethereum on Bitcoin. Wow.